Nobody in business enjoys seeing good customers go elsewhere. Obtaining new customers is typically the primary focus of a company in its early stages. Subsequently, the company expands its operations by providing existing customers with a broader range of products or working to increase the frequency with which they buy those products.

If everything continues to go according to plan, there will come a time when the company will reach a size where it will need to decide on a slightly more defensive strategy and concentrate on maintaining relationships with its existing clientele. Despite providing the best user experience possible, there will always be a subset of customers who are dissatisfied and opt to stop using the service.

Following this, the company is faced with the challenge of figuring out how to most efficiently stop these departures (voluntary or otherwise). The churn model, among other similar models, can help in this situation.

In this article, you will learn about Churn Prediction Model on Retail Data and how to build one, including how to fix and delete a prediction.

Table of Contents

What is Churn?

Churn refers to the loss of customers or subscribers over a specific period. It measures how many customers stop doing business with a company. In retail, churn typically involves customers who stop making purchases or engaging with the brand. Understanding churn helps businesses identify at-risk customers and develop strategies to retain them, reducing revenue loss.

Looking to seamlessly stream data sources like Stripe data in real-time? Hevo’s no-code platform allows you to automate the process and ensure your data is always analysis-ready. With Hevo, you can:

- Effortlessly extract data from 150+ connectors.

- Tailor your Stripe data needs with features like drag-and-drop and custom Python scripts.

- Achieve lightning-fast data loading of your Stripe data, making your data analysis-ready.

Try to see why customers like EdApp and Playtomic have upgraded to a powerful data and analytics stack by incorporating Hevo!

Get Started with Hevo for FreeTypes of Churn

- Voluntary Churn: When customers actively choose to stop using a product or service, such as canceling subscriptions or switching to a competitor.

- Involuntary Churn: When customers are lost due to external factors, like payment failures or account inactivity, without their intentional decision.

- Revenue Churn: Focuses on the loss of revenue due to downgrades, cancellations, or lost customers, even if the customer count remains steady.

- Customer Churn: The total number of customers who leave during a specific period, affecting the overall customer base.

Understanding these types helps in designing targeted strategies to reduce churn and improve retention.

What is Churn Prediction Model?

Churn Prediction Model is a predictive model that calculates, on an individual customer basis, the likelihood (or susceptibility) that a customer will stop doing business with the company. It gives you an indication, for each customer at any given time, of how high the risk is that you will lose them in the future.

It’s a binary classifier, which means that it divides customers into two distinct groups (classes) based on whether or not they leave the company. In most cases, in addition to placing them in one of the two groups, it will also tell you the likelihood that the customer is a member of that group.

Churn Prediction Modeling Techniques

- Logistic Regression: A commonly used technique for binary outcomes (churn or no churn). It helps in predicting the probability of a customer leaving based on certain factors.

- Decision Trees: These models create a tree-like structure to classify customers based on their features. It’s easy to interpret and helps identify key factors that lead to churn.

- Random Forests: An extension of decision trees, random forests combine multiple trees to improve prediction accuracy and avoid overfitting, making it a popular choice for churn prediction.

- Support Vector Machines (SVM): SVM helps in separating customers into churn and non-churn categories by finding the best boundary between the two groups.

- Neural Networks: A deep learning technique that mimics the human brain, which can be used to predict churn by identifying complex patterns in customer behavior.

- Survival Analysis: This method helps predict the “lifespan” of a customer, offering insights into when a customer is most likely to churn.

Each of these techniques has its strengths, and the best one to use often depends on the nature of the data and the business problem at hand.

Uses of Churn Prediction Model

When you have a better idea of which customers are most likely to defect, you can direct your efforts to save more of those customers. You could, for instance, reach out to these customers using a marketing campaign, pointing out to them that they haven’t made a purchase from us in quite some time, or we could even present them with an incentive.

The Churn Prediction Model allows us to determine which customers to target, and to compute the highest possible benefit price at which the investment will still be profitable. If we know, for instance, that the estimated probability of a particular client leaving is 10 percent and that their annual revenue is $100, then the expected value of future annual revenue is $90. Therefore, an offer that can typically reduce the probability of leaving to 5 percent (the expected value of the revenue is then $95, which means that it will be worthwhile as long as it does not cost more than $5) will be worthwhile for this client.

Building a Churn Predictive Model on Retail Data Process

One of the most important aspects of the Unified Customer Profile is the retail channel churn prediction model, which employs an AI-based model to assist omnichannel retailers in utilizing cross-channel data to determine the likelihood that a customer will churn, or stop actively buying.

Prerequisites

The prerequisites of building a Churn Prediction Model are as follows:

- Components geared toward the retail market are offered by Microsoft Cloud for Retail and can be found in the Microsoft Cloud Solution Center.

- An understanding of what the term “churn” means in the context of your organization. When the purchase value or volume of a customer falls below the thresholds that you set, you can consider that customer to have churned.

- Entities with fields that map to inputs for your retail churn prediction model:

- Customer data

- Session data

- Transaction data

Create a Churn Prediction Model on Retail Data

Follow the steps below to create a churn prediction model on retail data:

- Step 1: The first step in Churn Prediction Model is to choose Intelligence > Predictions from the drop-down menu in the Dynamics 365 Customer Insights portal.

- Step 2: Choose the Retail Channel Churn Tile, and then pick the Use model from the drop-down menu.

The screen for entering the Model name appears.

Model Name

The next step in building Churn Prediction Model is setting the model name.

- Step 1: Choose the Name option, then provide your churn model with a name that is clear and concise.

- Step 2: Choose the Output entity name option, then type in a name for the entity that will be produced by your model, using only letters and numbers (no spaces). The predictions that your model generates will be saved in this entity.

- Step 3: Click the Next button located at the bottom of the screen.

Model Preferences

The next step in Churn Prediction Model is to configure the model so that it can generate predictions that are appropriate for your company. These preferences include the number of days’ worth of data to evaluate and the input value thresholds that indicate churn.

- Step 1: On the screen labeled Preferences, choose the Prediction period option, then enter the number of days you would like the model to consider when determining the likelihood of churn in Churn Prediction Model.

- Step 2: Choose the threshold for the decline in transaction volume, and then determine the percentage of transaction frequency that represents churn (for example, if you set it to 0.2, the model will interpret an 80 percent drop in transaction frequency as churn).

- Step 3: Choose the threshold for the decline in transaction value, and then select the percentage of total transaction value that represents churn in Churn Prediction Model (for example, if you set it to 0.1, the model will interpret a 90 percent drop in transaction value as churn).

- Step 4: Click the Next button located at the bottom of the screen.

Required Data

The next step in Churn Prediction Model is to add required data:

- Step 1: Find the customer, session, and transaction entities that you determined are necessary first.

- Step 2: Select “Add data” for each entity, and then select the entity that you determined to be its source.

- Step 3: Choose the corresponding customer, session, or transaction input that you determined to be necessary for each of the fields on the form. These are the prerequisites.

- Step 4: Click the Save button once all of the fields have been filled in.

- Step 5: Click the Next button located at the bottom of the screen.

Data Updates

In this section of Churn Prediction Model, you will choose how frequently your model will undergo retraining. The accuracy of predictions can be improved through retraining.

- Step 1: Choose between weekly and monthly options. Most companies can retrain their employees once per month and still achieve a high level of accuracy in their predictions. Choose to Show Example for a little bit more assistance in making a decision.

- Step 2: Choose the Next option at the very bottom.

Review and Run

To review and run model details in Churn Prediction Model:

- Step 1: Review your model details. You can change any value by selecting Edit next to it, or you can select an earlier step in the process on the left.

- Step 2: If everything appears to be in order, you can skip this step. Choose Save from the drop-down menu in the bottom-right corner of the window if you are not yet prepared to run your churn model. When you are ready to continue working on it, go to the Customer Insights navigation pane and select Intelligence > Predictions. After that, go to the My predictions tab and select the edit icon that is located next to the name of the draught model’s Prediction.

- Step 3: To get started with the prediction process in Churn Prediction Model, select the Save and run option. You can view the current status of your predictions by clicking the tab labeled “My Predictions.” The amount of data utilized in the prediction will determine how long it will take to finish the process, which could take several hours.

Review Prediction Status and Results

To check the current state of a prediction and its results in Churn Prediction Model:

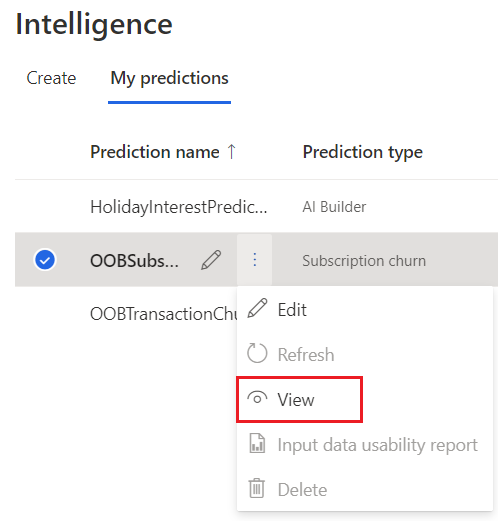

- Step 1: Select the My predictions tab after navigating to the Intelligence > Predictions menu option.

- Step 2: Choose View from the menu that appears after you select the three dots that are located next to the name of the prediction whose results you wish to review.

- Step 3: On the results page of Churn Prediction Model, the most important parts of the data are organized as follows:

- The performance of the training model could receive a score of A, B, or C. This score indicates how accurate the prediction was and can assist you in determining whether or not to make use of the results that were saved in the output entity. The following guidelines are used to calculate each player’s score:

- A when the model accurately predicted at least fifty percent of the total predictions and when the percentage of inaccurate predictions for customers who became inactive was less than ten percent.

- B when the model accurately predicted at least fifty percent of the total predictions, and when the percentage of inaccurate predictions for customers who became inactive was more significant than ten percent.

- C is assigned when the model correctly predicted less than half of the total predictions.

- Churn risk as a percentile: Categorizing customers into groups according to the likelihood that they will leave your service. If in the future you decide you want to create a segment of customers who have a high propensity to churn, you can use these data as a guide. These types of segments help you understand, for instance, where the cutoff point should be for the customer retention segments you’re looking at.

- Most influential attributes: The most important aspects to consider when making a prediction are the many elements that make up the whole picture. When creating aggregated predictions, a model takes into account all of the relevant factors and calculates their relative weights. You can use the results of your predictions to validate these factors by using them. This information can also be used to create segments that could help influence the churn risk for customers.

- Record-level Explainability: The output entity includes a table that outlines the significant factors that influenced each retail churn score as part of its record-level explainability. You have the option of exporting these tables for a variety of uses.

Fix a Failed Prediction

If a prediction was incorrect, an error message will appear with an explanation of what went wrong. For instance, when the model was executed, it did not find any customers who were “churning,” and the model did not pass training. If this occurred, it is possible that the transaction thresholds were set too low.

To attempt to improve a prediction by going through previous error logs:

- Step 1: Select the tab labeled “My predictions” after navigating to the Intelligence > Predictions menu option.

- Step 2: Choose the prediction you would like to examine, and then select Logs.

- Step 3: Examine every mistake. A description of the circumstances that led to each error can assist you in determining how to resolve the issue at hand. For instance, if you load more data, you can fix an error that says there is not enough information to make an accurate prediction of customer churn. Alternately, an error that indicates that your model is producing a prediction of zero customers leaving could mean that you need to revise your model preferences to include higher thresholds that indicate churn.

Delete a Prediction

- Step 1: Select the tab labeled “My predictions” after navigating to the Intelligence > Predictions menu option.

- Step 1: Choose the ellipsis in the vertical position next to the prediction you wish to remove from the list.

- Step 1: Select Delete.

Challenges in Churn Prediction

- Data Quality and Availability: Inaccurate or incomplete data can lead to misleading predictions. Ensuring that data is clean, comprehensive, and up to date is essential for accurate churn forecasting.

- Customer Behavior Complexity: Customer churn is influenced by many factors, some of which may not be immediately obvious or quantifiable, such as emotions or external events, making it difficult to predict accurately.

- Imbalanced Data: Often, the number of customers who churn is much smaller than those who stay, creating an imbalance in the data. This makes it harder for models to accurately predict churn without overfitting.

- Changing Patterns: Customer behavior can change over time due to market trends or external factors. A model trained on past data may not always adapt to new patterns, leading to inaccurate predictions.

- Feature Selection: Identifying the right features to predict churn can be challenging. Using too many irrelevant features can lead to overfitting, while using too few may miss important predictive signals.

- Model Interpretability: Some advanced models, like neural networks, can be difficult to interpret, making it hard for businesses to understand the reasons behind a churn prediction and act on it effectively.

By addressing these challenges, businesses can improve the accuracy of their churn prediction models and take proactive steps to reduce customer attrition.

Why is Churn Prediction Model Important?

- Customer Retention: A churn prediction model helps businesses identify customers who are likely to leave. This allows them to take targeted actions to retain those customers, such as offering personalized incentives or improving customer service.

- Cost-Effective Marketing: By predicting churn, companies can focus their marketing efforts on high-risk customers rather than spending on broad campaigns. This leads to better resource allocation and improved return on investment (ROI).

- Improved Customer Experience: With insights from churn prediction models, businesses can understand pain points and improve the overall customer experience. Proactive engagement based on churn signals can result in higher customer satisfaction.

- Informed Business Strategy: Churn prediction models provide valuable insights into the reasons behind customer attrition. This helps businesses adapt their products, services, and strategies to meet customer needs and reduce churn.

- Revenue Growth: By minimizing churn, businesses can maintain a stable customer base, which is essential for long-term revenue growth. Reducing churn is often more cost-effective than acquiring new customers.

- Competitive Advantage: Businesses that can predict and act on churn signals gain a competitive advantage by staying ahead of customer behavior trends, allowing them to make informed, proactive decisions.

Also, take a look at how you can set up Churn Analysis in Excel easily step-by-step.

Conclusion

When you have finished preparing the Churn Prediction Model, the next step is to incorporate it into the day-to-day operations of the company. This requires constant monitoring, evaluation, and updating of the system (which may simply consist of re-training the system or may even involve the addition of new features).

As a consequence of this, you can begin to automatically recognize events that tend to increase the propensity to leave and that require a response as quickly as possible.

In this article, you learned how to build a churn prediction model for retail data and how to review the status and results along with how to delete and fix a failed prediction.

However, as a Developer, extracting complex data from a diverse set of data sources like Databases, CRMs, Project management Tools, Streaming Services, and Marketing Platforms to your Database can seem to be quite challenging. If you are from non-technical background or are new in the game of data warehouse and analytics, Hevo Data can help!

Sign up for a 14-day free trial and simplify your data integration process. Check out the pricing details to understand which plan fulfills all your business needs.

Frequently Asked Questions

1. What is the best model to predict churn?

The best model depends on your dataset and business needs. Commonly used models include Logistic Regression, Decision Trees, Random Forest, and Neural Networks. Advanced techniques like Gradient Boosting (e.g., XGBoost) are also effective for accurate predictions.

2. What is a churn prediction model?

A churn prediction model is a data-driven tool that analyzes customer behavior and identifies individuals likely to stop using a product or service. It helps businesses take proactive steps to reduce churn.

3. How to build a customer churn prediction model?

1) Define the Problem: Identify what constitutes churn.

2) Gather Data: Collect historical customer data (e.g., transactions, engagement).

3) Preprocess Data: Clean and prepare data for analysis.

4) Choose a Model: Use algorithms like Logistic Regression or Random Forest.

5) Train and Validate: Split data into training and testing sets to build and evaluate the model.

6) Deploy and Monitor: Implement the model and monitor its performance over time.